Download the Bestinvest app

Our Coaches are qualified financial planners who can help with your investment goals. All for no charge.

The value of your investments and the income from them may go down as well as up, and you could get back less than you invested.

Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

Invest on the go

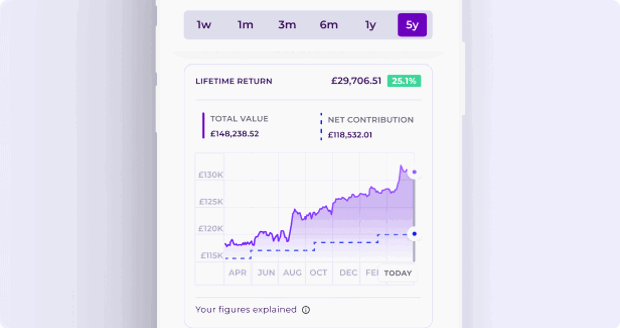

See how your investments are performing

View your account balances and online investment performance 24/7.

Buy & sell shares and funds

Buy and sell over 3,000 funds, shares, exchange-traded funds (ETFs) and Ready-made Portfolios.

Open or transfer in an account

Open or transfer in a Stocks & Shares ISA, Junior ISA, Self-invested Personal Pension (SIPP) and Investment Account.

Plan ahead

Add cash or set up monthly payments

Top up your account from the app, or set up regular contributions.

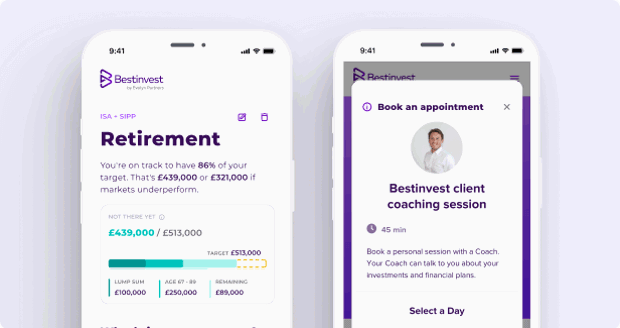

Book a free coaching session

Set up a free investment coaching session with one of our qualified financial planners.

Set up a goal

Set, track and discover how to achieve your investment goals with our smart planning tools.

See the bigger picture

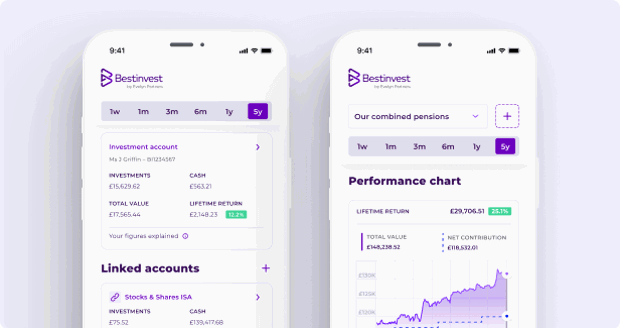

See your family’s accounts in one place

Link your account to your family and friends to manage and plan your financial futures together.

Group accounts together

View different accounts together to see their value and performance.

Read our investment insights

Stay up to date with the latest investment insights, trends and news.

Download the Bestinvest app today

Frequently asked questions

What is a Coach?

Our Coaches are all qualified financial planners who are trained to give you general guidance to help with your investing. This may include information about different types of investments or principles for you to follow.

What qualifications do our Coaches have?

All our Coaches are level 4 Diploma qualified and hold either a CII or LIBF Diploma in Regulated Financial Planning.

What should I bring to my Coaching session?

To make sure your coaching session is as effective as possible, please bring details of any investments you may already have. This includes everything from workplace pensions to ISAs, SIPPs and investment accounts.